Area of Focus

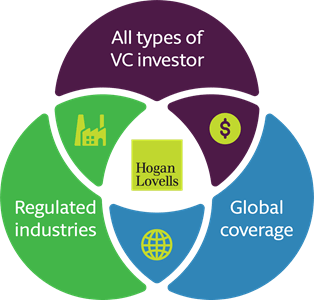

We have a balanced practice advising strategic investors, financial investors as well as emerging companies at any stage of the "venture capital lifecycle" - whether early, mid-stage or late stage and growth equity or last dollars before an exit, and beyond.

This means that we have a unique ability to understand perspectives from all sides of the table which is critical in developing solutions that help investors and innovators stay ahead of the curve.

Our lawyers are highly experienced in their local markets and are firmly embedded within their local ecosystems, but also connected with each other in sharing ideas and opportunities, leveraging our unique worldwide reach and capability to provide international insight to our clients.

Fast growth businesses are transforming every industry with disruptive business models. Our industry focus enables us to identify, and anticipate regulatory changes, market dynamics, and trends that will redefine the shape of an industry. We have our finger on the pulse. We can help spot investment opportunities and support growth companies to learn and change.

Our world leading regulatory expertise means we don't just understand regulation; we can shape it, challenge it and navigate it. Just as we can help investors to understand, identify and deal with regulatory risks affecting their investments, we can help growth businesses leverage regulation to become stronger where it matters.

Representative experience

Facebook on its US$5.7bn investment in Jio Platforms Limited, the largest minority tech investment in history, and the largest foreign direct investment in the Indian tech sector.

Flipkart, one of India's leading digital commerce entities, on its US$1.2bn fundraising; its US$700m fundraising for PhonePe, a payments business; and most recently on its US$3.6bn fundraising.

FlixMobility on its Series F funding round. This transaction is one of the largest equity financing rounds ever completed in Germany.

Verkor, a French industrial company, on its record financing of more than €2bn to launch a high-performance battery gigafactory in France.

Gilead Sciences on its investment in the US$120m Series B financing of AlloVir, formerly known as ViraCyte.

Mouro Capital (f/k/a Santander InnoVentures) on numerous fintech investments including its investments in Upgrade, Blueprint Title, and DriveWealth as well as a follow-on investment in Crosslend.

Accel, Eurazeo and various investors on Sorare's record $680m Series B, valuing it at $4.3bn.

Norwest Venture Partners on a number of investments including on its Series D-2 investment in Grove Collaborative and on its investment in Algorithmia’s US$25m Series B financing round.

Affirma Capital on its participation, as lead investor, in the US$93m Series B funding round of Beam Mobility Holdings Pte. Ltd., a Singapore-based micromobility operator.

Walmart on its joint venture with Ribbit Capital to create a new fintech start-up.

Area of Focus

Financial Venture Capital Investors

Area of Focus

Emerging Companies

Area of Focus

Automotive Venture Capital

Area of Focus

Consumer Venture Capital

Area of Focus

FinTech Venture Capital

Area of Focus

Life Sciences and Health Care Venture Capital

Area of Focus