During the last decade, the shape and source of capital flows and investment have fundamentally shifted. Private equity and debt markets have grown and are becoming more mainstream, more diverse, and more liquid. Private capital continues to flow into all asset classes including real estate, infrastructure, private credit, and private equity.

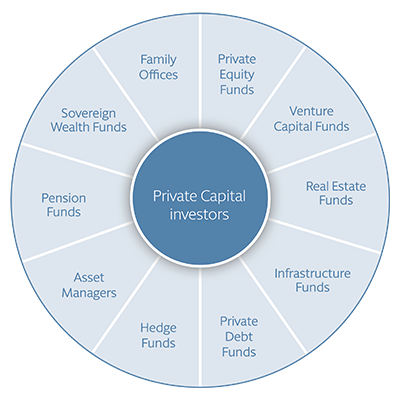

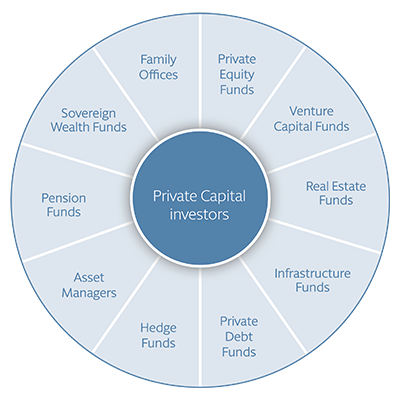

We advise all types of private capital investors including many of the largest and most sophisticated players in the industry – from 'traditional' funds to alternative investors – on their investment strategies across every asset class, industry and geography.

From pre-fundraising through to deploying capital, including managing portfolio companies, exiting investments, and fund dissolution, as well as ensuring tax structures are optimized, we help with the complete private capital lifecycle.

Our industry focus enables us to help private capital investors identify and harness opportunities across all industries – from traditional industries like real estate and infrastructure to fast growing areas such as technology and life sciences.

Our preeminent regulatory and compliance lawyers work with private capital investors to deal with sanctions, anti-bribery and corruption, data privacy, and cybersecurity risks.

Our unique global platform enables us to advise private capital investors wherever they decide to invest.